Summary

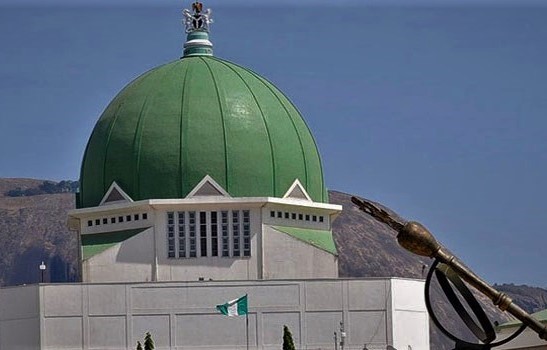

On October 5, 2021, the Senate of the Federal Republic of Nigeria passed the Establishment of the Tertiary Hospitals Development Fund Bill 2021 (the “Bill”), which seeks to impose new taxes on companies; for the purpose of promoting tertiary healthcare development in the country. The Bill seeks to establish the Tertiary Hospitals Development Fund (the “Fund”) for the rehabilitation, restoration, and consolidation of tertiary healthcare in Nigeria. The functions of the Fund will include the provision and maintenance of infrastructure essential for tertiary healthcare service delivery, conduct of health research and publications, and execution of clinical staff training and development. The Fund will be financed by several sources, including monies generated from the new taxes sought to be imposed on companies by the Bill.

Essentially, the new taxes sought to be imposed on companies by the Bill include:

(a) 1% of petroleum companies tax paid on total barrels of crude oil produced yearly;

(b) 1% of mobile phone service providers’ tax paid on airtime and data sold yearly;

(c) 1% of paint and chemical manufacturing companies tax paid on profits declared yearly;

(d) 1% of beverages and breweries companies tax paid on profits declared yearly;

(e) 1% of tobacco companies tax paid on profits declared yearly; and

(f) 1% of cement companies tax paid on profits declared yearly.

The tax imposed is to be administered by the Governing Board to be established for the Fund (“Governing Board”). However, the responsibility for assessing and collecting the tax rests with the Federal Inland Revenue Service (“FIRS”). The Bill provides that, when assessing a company for companies’ income tax in any relevant accounting period, the FIRS shall also assess the company for the tax due under the Bill. The FIRS is to be supported in this process by the Governing Board, which shall also be responsible for disbursing the amounts in the Fund to tertiary hospitals specifically for healthcare development purposes; including provision of essential physical infrastructure for medical research, teaching, learning, and other services equipment. The Fund, under the overall direction of the Governing Board, is expected to monitor and ensure collection of the tax by the FIRS and further ensure subsequent transfer of same to the Fund. In the course of managing and disbursing the tax imposed by the Bill, the Fund is also expected to liaise with the appropriate ministries or bodies responsible for collection or safekeeping of the tax.

Commentary

The Fund sought to be established by the Bill for the rehabilitation, restoration, and consolidation of tertiary healthcare in Nigeria is a welcome development, as it will enhance the quality of healthcare delivery in the country. However, the additional taxes to be imposed on companies by the Bill is likely to increase the tax burden of companies and impact the ease of doing business in Nigeria.

While the Bill will have to get the concurrence of the House of Representatives before it can be transmitted for the President’s assent, we believe that further discussions should be had on the Bill before it is enacted into law. In this regard, our view is that legitimate concerns regarding the metrics for correct determination of the taxes; particularly the “1% of the airtime and data sold yearly by mobile phone service providers” and “1% of the total barrels of crude oil produced yearly by petroleum companies”, should be adequately addressed. In our view, greater clarity is required on whether the basis for the assessment of these two highlighted taxes, will be the relevant annual revenue or profits of mobile phone service providers and petroleum companies.

Companies engaged in upstream oil and gas production, mobile phone services provision, paint and chemical products manufacturing, beverages production and breweries, and tobacco and cement production; will need to closely monitor the progress of the Bill and make appropriate assessments regarding its likely impact on their business operations. Entities affected by the Bill should consult their legal and tax advisers for appropriate guidance on how best to respond to the Bill, and the compliance requirements that may be applicable to their businesses if the Bill is eventually passed into law.

The Grey Matter Concept is an initiative of the law firm, Banwo & Ighodalo.

DISCLAIMER: This article is only intended to provide general information on the subject matter and does not by itself create a client/attorney relationship between readers and our Law Firm or serve as legal advice. We are available to provide specialist legal advice on the readers’ specific circumstances when they arise.

Click here to read our Tax Alert 20