BACKGROUND

Ordinarily, under the extant laws governing tax and taxation in Nigeria, tax evasion constitutes a crime punishable, upon conviction, by imprisonment of a term up to five (5) years while the taxpayer will, in addition, be required to pay the tax due along with the accrued interest (typically at 21%) and also subjected to the associated penalties (a fine of usually 10% of the assessed tax due and in some cases forfeiture of the related assets to Government). However, figures released by the Joint Tax Board (“JTB”) in May 2017 revealed that, the total number of taxpayers stands at 14 million out of an estimated 69.9 million economically active persons in Nigeria. This statistics has been advanced by many analysts as the reason behind the country’s abysmally low tax-to-GDP ratio of 6%, which compares unfavorably with other countries of the world (i.e. Ghana, 15.9%; India, 16%; South Africa, 27%; and countries of the OECD with an average of 34%).

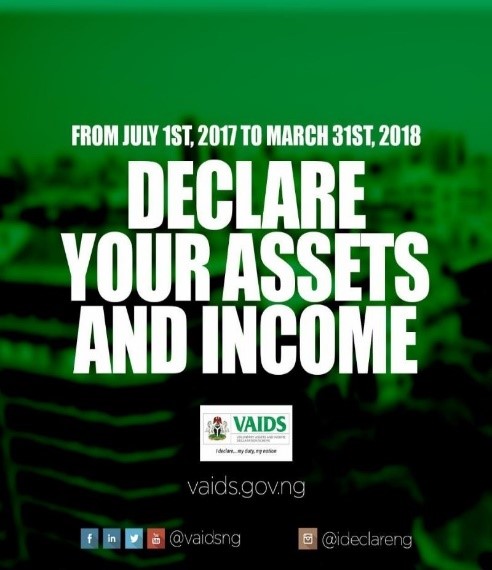

The Federal Government of Nigeria (“FGN”), in realisation of the facts that the country’s low tax revenues could be due in part to lack of awareness among the citizens of prompt and accurate tax payments as a civil obligation, asides the willful acts of tax evasion prevalent among some persons; decided to grant a period of Tax Amnesty to all taxpayers who are in default of their tax liabilities instead of outright prosecution for tax offences as stipulated in the relevant tax statutes. In furtherance of this resolve, the FGN, through the Vice President, Professor Yemi Osinbajo, SAN, in his capacity as Acting President of the FRN at the time signed, on June 29, 2017, the Executive Order No. 004 of 2017 (“Executive Order”). The Executive Order provided the framework upon which the Ministry of Finance, JTB and the Federal Inland Revenue Service (“FIRS”) have jointly established the Voluntary Assets and Income Declaration Scheme (“VAIDS”).

This article looks at the nitty-gritty of the VAIDS, which will be available for taxpayers for only a period of nine (9) months between July 1, 2017 and March 31, 2018 and presents reasons why taxpayers should take advantage of the tax amnesty offered by the VAIDS, before the limited period for regularisation lapses.

OBJECTIVES OF VAIDS

The objectives sought to be achieved through the VAIDS include:

- Provision of a time-limited Tax Amnesty to taxpayers who are in default of their tax obligations to enable them regularise their tax positions without payment of statutorily prescribed penalties or fear of criminal prosecution for tax offences;

- Enhancement of the FGN’s projection for a higher tax-to-GDP ratio for the country;

- Attainment of better rates of tax awareness and compliance among Nigerian citizens and residents;

- Improvement on non-oil earnings for the FGN and internally generated revenue (“IGR”) for state governments; and

- Provision of a viable alternative to borrowing for the financing of infrastructure.